As I delve into the world of proprietary trading firms, I find myself captivated by the unique dynamics that define this sector of finance. Proprietary trading, often referred to as “prop trading,” involves firms trading financial instruments using their own capital rather than clients’ funds. This model allows traders to engage in a variety of strategies, from high-frequency trading to long-term investments, all while reaping the rewards of their own successes.

The allure of potentially high returns, coupled with the thrill of navigating the fast-paced financial markets, draws many individuals into this competitive arena. I have come to appreciate how these firms operate at the intersection of risk and reward, where skilled traders can leverage their expertise to generate significant profits. In my exploration of proprietary trading firms, I have also recognized the critical role they play in enhancing market liquidity and efficiency.

By actively participating in the markets, these firms contribute to price discovery and help ensure that assets are traded at fair values. This involvement not only benefits the firms themselves but also supports the broader financial ecosystem. As I reflect on my experiences and observations, I realize that proprietary trading is not merely about making money; it is about understanding market dynamics, developing sophisticated strategies, and continuously adapting to an ever-changing landscape.

The blend of analytical skills, market intuition, and risk management is what makes this field both challenging and rewarding.

Key Takeaways

- Proprietary trading firms are financial institutions that trade with their own capital rather than clients’ money.

- Pre-market preparation and research are essential for traders to analyze market trends and make informed decisions.

- The trading desk environment is fast-paced and dynamic, requiring quick thinking and adaptability.

- Market hours and trading activities vary depending on the asset class and geographical location.

- Risk management and compliance are crucial to ensure the firm operates within legal and regulatory boundaries.

Pre-Market Preparation and Research

Before the market opens, I find that pre-market preparation is crucial for any trader looking to gain an edge. This phase involves extensive research and analysis, where I immerse myself in various sources of information to identify potential trading opportunities. I often start by reviewing overnight news and economic reports that could impact market sentiment.

Understanding global events, such as geopolitical developments or economic indicators, allows me to anticipate how they might influence market movements once trading begins. Additionally, I analyze pre-market trading activity to gauge investor sentiment and identify stocks that are experiencing significant price changes before the official opening bell. In my pre-market routine, I also focus on technical analysis, examining charts and patterns that may signal potential entry or exit points for trades.

By studying historical price movements and identifying key support and resistance levels, I can formulate a strategy that aligns with my risk tolerance and trading goals. Furthermore, I make it a point to review my watchlist of stocks that I have been monitoring closely. This list serves as a foundation for my trading decisions throughout the day.

By combining fundamental analysis with technical insights, I feel more prepared to navigate the complexities of the market as it opens.

Trading Desk Environment

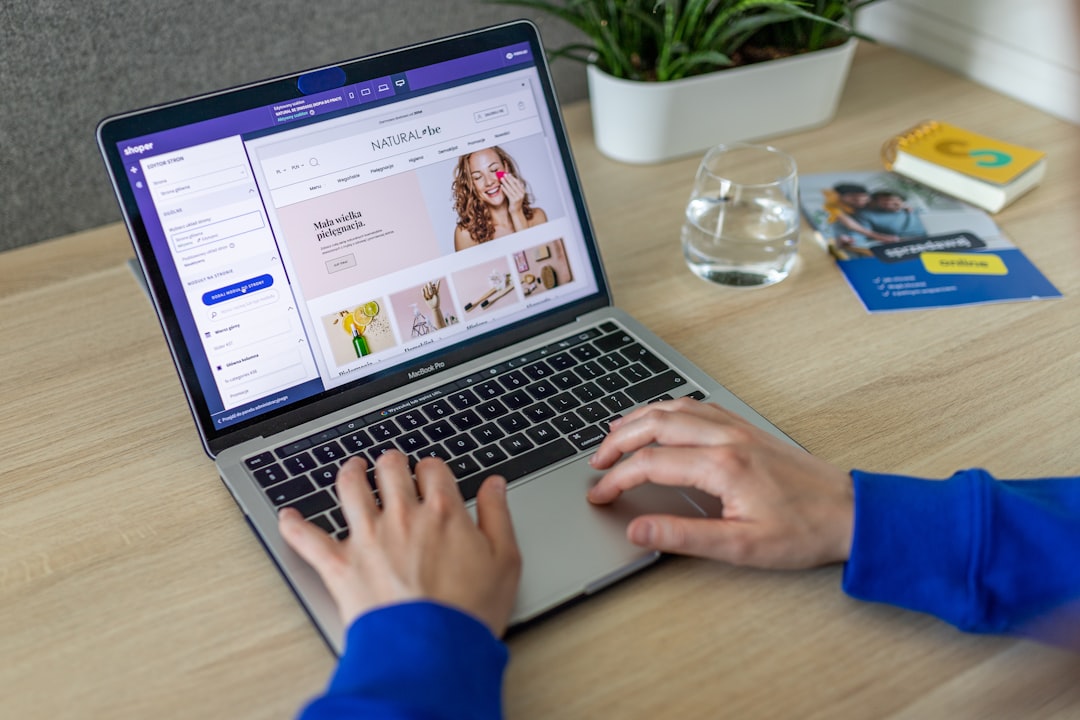

The trading desk environment is a vibrant and dynamic space that embodies the essence of proprietary trading. As I sit at my desk surrounded by multiple monitors displaying real-time market data, I am acutely aware of the energy that permeates the room. The atmosphere is charged with anticipation as traders engage in discussions about market trends, share insights, and strategize their next moves.

The constant flow of information from news feeds, financial reports, and social media creates an exhilarating backdrop for decision-making. In this environment, every second counts, and being attuned to market fluctuations is essential for success. Collaboration is a key aspect of the trading desk experience.

I often find myself exchanging ideas with fellow traders, discussing potential trades, and analyzing market conditions together. This collaborative spirit fosters a sense of camaraderie and encourages us to learn from one another’s experiences. Additionally, the presence of seasoned mentors provides invaluable guidance as I navigate the complexities of trading strategies and risk management.

The trading desk is not just a place for individual performance; it is a collective effort where each trader contributes to the overall success of the firm.

Market Hours and Trading Activities

When the market opens, I am fully immersed in a whirlwind of trading activities that demand my complete focus and attention. The initial moments after the opening bell are often characterized by heightened volatility as traders react to overnight news and economic data releases. During this time, I must remain vigilant, monitoring price movements and executing trades based on my pre-established strategies.

The adrenaline rush that accompanies this fast-paced environment is both exhilarating and challenging; it requires me to think quickly while remaining disciplined in my approach. Throughout the trading day, I engage in various activities that range from executing trades to managing open positions. I constantly assess market conditions, adjusting my strategies as necessary to capitalize on emerging opportunities or mitigate potential losses.

The ability to adapt in real-time is crucial; markets can shift rapidly based on new information or unexpected events. As I navigate these fluctuations, I rely on my analytical skills and intuition to make informed decisions that align with my overall trading plan. Each trade becomes a learning experience, contributing to my growth as a trader.

Risk Management and Compliance

In the world of proprietary trading, risk management is paramount. As I engage in trading activities, I am acutely aware of the potential for losses and the importance of protecting my capital. Developing a robust risk management strategy involves setting clear parameters for each trade, including stop-loss orders and position sizing based on my risk tolerance.

By adhering to these guidelines, I can minimize potential losses while maximizing opportunities for profit. This disciplined approach not only safeguards my investments but also instills a sense of confidence as I navigate the unpredictable nature of the markets. Compliance is another critical aspect of proprietary trading that cannot be overlooked.

As traders, we operate within a framework of regulations designed to ensure fair practices and protect market integrity. Staying informed about compliance requirements is essential; it involves understanding rules related to reporting trades, maintaining accurate records, and adhering to ethical standards. By prioritizing compliance in my trading activities, I contribute to fostering a culture of integrity within the firm while also safeguarding my own reputation as a trader.

Team Collaboration and Communication

Team collaboration is an integral part of my experience at a proprietary trading firm. While individual performance is important, the collective knowledge and expertise of the team can significantly enhance our overall success. Regular meetings provide an opportunity for us to share insights about market trends, discuss strategies, and analyze past trades.

These discussions foster an environment where we can learn from each other’s successes and mistakes, ultimately improving our decision-making processes. The synergy created through collaboration often leads to innovative ideas that can be implemented in our trading strategies. Effective communication is essential in this fast-paced environment.

As trades are executed in real-time, clear communication among team members ensures that everyone is aligned on strategies and objectives. Whether it’s through instant messaging platforms or face-to-face discussions at our desks, maintaining open lines of communication allows us to respond quickly to changing market conditions. Additionally, sharing information about potential risks or opportunities helps us make more informed decisions collectively.

In this collaborative atmosphere, I feel empowered to contribute my insights while also benefiting from the diverse perspectives of my colleagues.

After-Hours Analysis and Review

Once the market closes for the day, my work is far from over; in fact, it is during this time that some of the most valuable learning occurs. After-hours analysis involves reviewing my trades from the day—what worked well and what didn’t—and identifying areas for improvement. This reflective practice allows me to dissect each trade’s rationale and outcome critically.

By analyzing my decision-making process and understanding how external factors influenced market movements, I can refine my strategies for future trading sessions. In addition to personal analysis, I also engage with my team during after-hours reviews. These sessions provide an opportunity for us to discuss our collective experiences from the day’s trading activities.

Sharing insights about successful trades or discussing mistakes fosters a culture of continuous improvement within our team. We often explore different perspectives on market behavior and strategize how we can adapt our approaches moving forward. This collaborative review process not only enhances our individual skills but also strengthens our team dynamics as we work together toward common goals.

Work-Life Balance and Conclusion

As I reflect on my journey within proprietary trading firms, I recognize that maintaining a healthy work-life balance is essential for long-term success in this demanding field. The intensity of trading can easily lead to burnout if one does not prioritize self-care and personal time outside of work hours. I have learned that setting boundaries—such as designating specific times for relaxation or pursuing hobbies—can significantly enhance my overall well-being and productivity as a trader.

In conclusion, my experiences within proprietary trading firms have provided me with invaluable insights into the intricacies of financial markets and the importance of collaboration, risk management, and continuous learning. The thrill of navigating this fast-paced environment is matched only by the satisfaction derived from honing my skills as a trader. As I continue on this journey, I remain committed to balancing my professional aspirations with personal fulfillment—an endeavor that ultimately enriches both my career and life as a whole.

FAQs

What is a proprietary trading firm?

A proprietary trading firm is a financial institution that trades for its own account rather than on behalf of clients. These firms use their own capital to make speculative trades in various financial instruments such as stocks, options, futures, and commodities.

What does a typical day at a proprietary trading firm look like?

A typical day at a proprietary trading firm involves analyzing market data, executing trades, managing risk, and developing trading strategies. Traders may also engage in research, attend meetings, and collaborate with colleagues to identify profitable opportunities in the market.

What are the key responsibilities of employees at a proprietary trading firm?

Employees at a proprietary trading firm are responsible for conducting market analysis, executing trades, managing risk, developing trading strategies, and staying informed about market trends and news. They may also be involved in technology development and maintaining trading systems.

What skills are required to work at a proprietary trading firm?

Working at a proprietary trading firm requires strong analytical skills, a deep understanding of financial markets, the ability to make quick decisions under pressure, and proficiency in programming and quantitative analysis. Additionally, effective communication and teamwork skills are important for collaborating with colleagues and sharing insights.

What are the career opportunities at a proprietary trading firm?

Career opportunities at a proprietary trading firm include roles such as trader, quantitative analyst, risk manager, software developer, and research analyst. Employees may also have the opportunity to advance to leadership positions and take on greater responsibilities within the firm.